Regulators’ Approval of a US Spot Bitcoin ETF May Be Imminent

**Record Discount Narrows for Grayscale Bitcoin Trust**

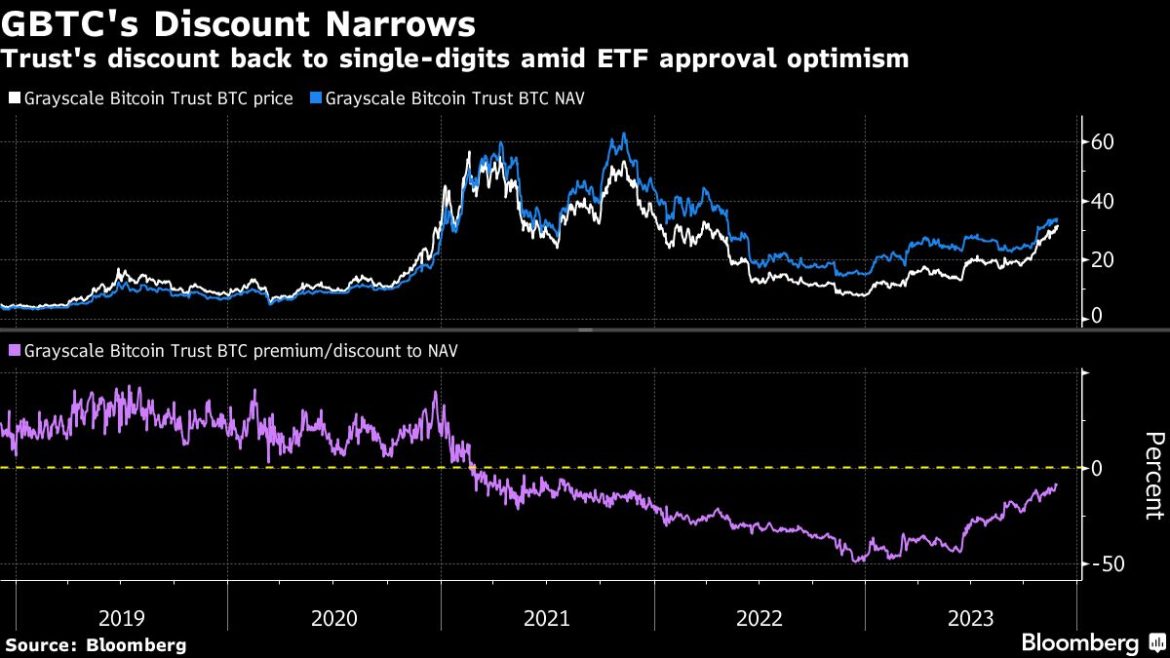

After trading at a record discount of nearly 50% as 2023 began, the $24 billion Grayscale Bitcoin Trust (ticker GBTC) is now trading at a roughly 8% discount to its underlying Bitcoin holdings. This is the narrowest dislocation in over two years, according to data compiled by Bloomberg. The quickly narrowing discount reflects building optimism that the US Securities and Exchange Commission (SEC) is poised to allow physically-backed Bitcoin exchange-traded funds (ETFs) to launch after years of denials.

**Disappearance of Previously Huge Discount on GBTC**

Many market observers believe that the rapidly narrowing discount on GBTC reflects increasing confidence in the approval of a spot Bitcoin ETF by the SEC. A wave of applications from asset-management giants like BlackRock Inc. combined with the SEC’s loss in court against Grayscale over the agency’s decision to block the bid to convert GBTC into an ETF have investors betting that this time may be different.

Nate Geraci, president of The ETF Store, an advisory firm, said, “It’s reasonable to view GBTC’s discount as essentially a live betting line on spot Bitcoin ETF approval. The remaining discount indicates this isn’t a done deal yet, but there’s clearly optimism in the air.”

**GBTC poised to Convert into a Spot Bitcoin ETF**

GBTC has traded at a persistent discount to its holdings since early 2021 due to its structure that doesn’t allow for redemptions, essentially turning it into a closed-end fund. However, growing conviction that GBTC will be able to convert into a spot Bitcoin ETF has fueled the product’s nearly 277% surge in 2023, far outpacing Bitcoin’s 128% increase and narrowing the discount in the process.

Speculation that GBTC will convert into an ETF following the SEC’s blessing has sent billions of dollars flooding into the Grayscale trust this year. According to JPMorgan Chase & Co., it’s likely that those funds will quickly exit after the fact. Additionally, there may be outflows totaling much more than $2.7 billion should Grayscale not lower its fee following a potential conversion. GBTC charges 2% annually, while competitors have listed a 0.8% fee on their spot-Bitcoin ETF application.

In an emailed comment, a spokesperson for Grayscale said they believed the trust’s assets under management “will likely grow after receiving approvals to trade as an ETF.”

**Prospects for GBTC and Future Expectations**

While the move so far this year has been dramatic, it’s unlikely that GBTC will return to trading at a premium to its holdings until ETF approval is a done deal. James Seyffart, an ETF analyst at Bloomberg Intelligence, said, “I don’t expect GBTC to head back into a premium before a conversion — though it’s technically possible. We believe that there’s a 90% probability of SEC Bitcoin ETF approval by January 10th but it’s not guaranteed just yet.”

I have been writing about crypto for over two years. I have a vast amount of experience in the industry and my work has been featured on some of the biggest publications in the space.